A planned vote on health insurance subsidies will be key to how Congress handles the next funding cliff at the end of January, market participants said.

-

Arrington announced he will not seek reelection in 2026 after helping shepherd President Trump's first major tax bill through Congress, marking the first GOP House chairman to check out in 2026.

53m ago -

Photos from The Bond Buyer's 2025 California Public Finance conference.

23m ago -

New York will license up to three casinos in New York City. What returns can the state and expect on new entrants to an increasingly crowded gambling market?

November 10 -

-

Some of the most active sectors have been education (+29%), GOs (+17%) and healthcare (+17%), said Kim Olsan, senior fixed income portfolio manager at NewSquare Capital.

November 10

As the Senate moves towards a possible deal to end the longest federal government shutdown in history, the "Big 7" of state and local lobbying groups along with the GFOA are making an urgent appeal.

Public transit emerged as an $11 billion winner in the 2025 elections as voters in five states approved measures to pour money into the sector.

An uncertain financial future partially due to federal government downsizing is compounding with nearly $6 billion of unfunded capital needs that will require Washington D.C. to lean on asset management and its strong credit rating to overcome the challenges.

Tom Falcone of the Large Public Power Council unpacks the massive infrastructure push driven by AI and manufacturing, and the policy hurdles standing in the way.

Photos from The Bond Buyer's 2025 Infrastructure conference.

David Hammer, head of municipal bond portfolio management at PIMCO, joins The Bond Buyer to discuss 2025's volatile muni landscape, credit strength vs. market weakness, and what smart investors are doing next.

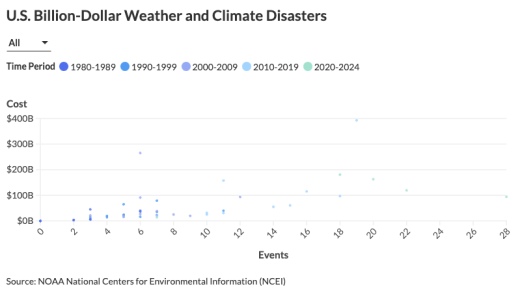

The steady demand for municipal bonds in high-risk areas underscores the complex relationship between climate change and financial markets.

Oppenheimer's Head of Public Finance Beth Coolidge and Columbus Auditor Megan Kilgore delve into the future of public finance and human infrastructure on a wide range of topics, from affordable housing and workforce development to public health, climate resiliency, and digital access.

As extreme weather events occur with more frequency across the country, Michael Gaughan, executive director of the Vermont Bond Bank, says municipal bond banks can help smaller communities deal with the effects of them. Gaughan speaks with The Bond Buyer's Lynne Funk on the effects of climate change and how the various levels of government can work together to address it.

Concerns over the Texas city's future water supply after a desalination project was terminated, led to negative rating outlooks from Fitch and S&P.

The rating agency's review was triggered by the city's move to effectively end plans for a seawater desalination project that has $235 million of bonds outstanding.

This year's portfolio growth will save the city $2.18 billion over the next five years, Comptroller Brad Lander said.

-

The $16,250 was part of a $150,000 total fine Wedbush agreed to pay to settle FINRA allegations.

November 10 -

The muni market may see additional volatility due to "uncertainties related to the future of tariffs and stronger inflation prints," said Barclays strategists led by Mikhail Foux.

November 7 -

The industry for years has lobbied Congress and the Treasury Department to make the changes, but the issue has taken on more urgency amid a data center boom that promises to transform the U.S. energy landscape

November 7 -

Fresno, California, received a boost to positive from stable on its senior lien airport revenue bonds.

November 7 -

Moody's cited very narrow liquidity, very high leverage and concerns about delays in opening up a new campus.

November 7